Scott Tominaga Talks About The Common Types Of Hedge Fund Strategies

Each and every person desires to identify ways that helps them to grow their money. They typically invest in certain investment vehicles that have minimal risk involvement and aids in growing their money with time. As mentioned by Scott Tominaga hedge funds are one of the ways that enables any kind of investor to get great returns for their investment. Hedge fund basically is an investment fund that is created by certain accredited individuals and institutional investors, with the aim of eliminating or reducing risk involvement, while maximizing returns. In the words of a layman, hedge funds can be defined as distinct investment partnership that takes place between a fund manager and the relevant investor of the fund.

Hedge fund strategies are a set of instructions and principles that are followed by hedge fund managers with the aim of protecting themselves against the movement of securities and stocks in the market, while having reduced risk involvement. Scott Tominaga says that such strategies are designed to help the investor to make profit on a very small working capital, while not having to risk the whole budget.

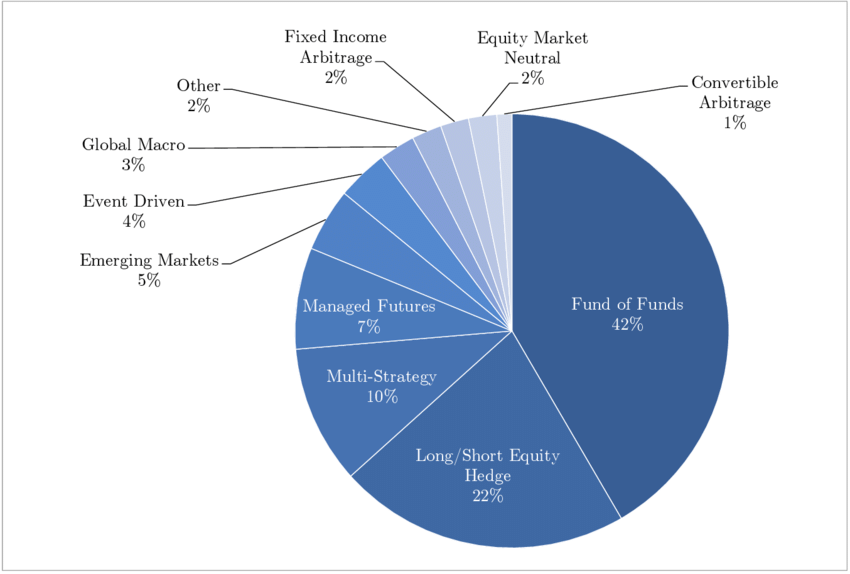

There are multiple hedge fund strategies that are followed by discerning types of investors today. Here are some of them:

- Long/Short Equity Strategy: In this type of a hedge fund strategy, the investment manager would be required to maintain both long and short positions in equity, as well as equity derivatives. As a result the fund manager would invest in stocks that they believe is undervalued, while selling the ones that seem to be overvalued. An expansive range of techniques are employed to arrive a distinct investment decision. An expansive range of techniques tend to be employed today, for the purpose of arriving at a prudent investment decision.

- Market Neutral Strategy: In this type of a strategy, however, hedge funds tend to target zero net-market exposure. This basically means that both their longs and shorts have equal market value. In this scenario, the managers would generate their whole return from the relevant stock selection. Market Neutral Strategy has much lower risk involvement than the long/short equity strategy; however, their expected returns are also lower.

- Convertible Arbitrage: Hybrid securities are known to feature a combination of bond, along with an equity option. Convertible Arbitrage hedge fund basically involves both short and long convertible bonds which would be required to be converted. In simple terms, they include long position on bonds, as well as short positions on common stock or shares. This strategy is aimed at garnering maximum profits whenever any kind of pricing error made in the conversion factor, while also aiming to capitalize on mis-pricing between a convertible bond and its distinct underlying stock.

As per Scott Tominaga there are multiple other major hedge fund strategies in addition to the ones mentioned above, including capital structure arbitrage strategy, fixed-income arbitrage strategy, event-driven strategy, global macro strategy and short only strategy.