Getting To Know More About the Advantages and Disadvantages of Forex Trading

What is Forex trading? Forex trading is the trading of two currency pairs in the Forex market, the biggest financial market in the world. But no matter how huge it is when it comes to the number of trades that come and go every day, there are advantages and disadvantages that are worth mentioning.

Advantages of Forex Trading

Flexibility

One of the most praiseworthy advantages of Forex trading is its flexibility. In the forex market, there is no such thing as restrictions when it comes to the number of funds that you can utilize when trading. It is also known to be an unregulated market, making it less strict and opens more opportunities for traders. More importantly, the market is open 24 hours a day, 7 days a week. You can trade anytime you want.

Wide Number of Trading Options

If you are not familiar with a trading option, then you can always go for another one. In fact, traders have the option to trade in hundreds of different currency pairs. They can enter a spot trade or opt for a future agreement. If traders opt for futures agreements, they can also enter in different sizes, and various maturities to sustain the needs of every Forex trader. This goes to show that the forex market opens a lot of opportunities, for different budgets and different investors with different risk appetites.

Transaction Costs

If you are worried about the transaction costs each time you open a trade or close a trade, then you shouldn’t worry so much. Transaction costs in the Forex market are quite low compared to other financial markets.

Leverage

And here comes leverage – the most talked-about advantage in Forex trading. The Forex market is known to be flexible, low transaction costs, variety of trading options, and most importantly, provides leverage. Most brokers offer as much as 20 to 30 times the amount of your initial investment. With this setting, you can surely magnify your gains despite the small movements of the market.

Disadvantages of Forex Trading

Let’s not make this a biased evaluation of what is Forex trading. If there are advantages, it is important to note that the Forex market also has disadvantages that you need to check before you trade.

Counterparty Risks

As you already know, the Forex market is categorized as an international market. As for the regulation, it would be difficult to follow, especially due to the different sovereignty of currencies. This makes the forex market unregulated and no centralized exchange that could guarantee risk-free trading.

Leverage Risks

As mentioned on the advantages, leverage is a good thing but can turn into a disaster if mishandled. For novice traders, they can make mistakes that can cost them their entire trading account. Most importantly, leverage does mirror profits but it also mirrors losses.

Operational Risks

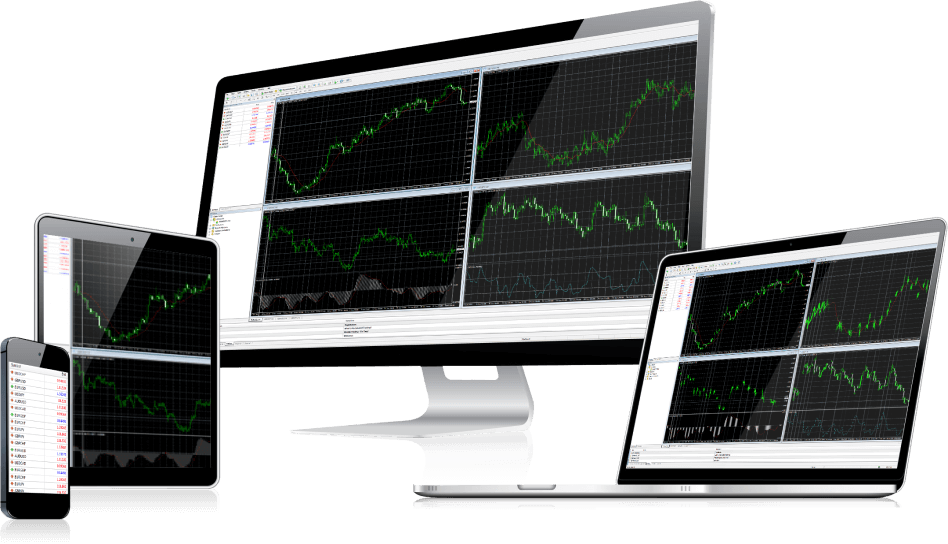

For some reason, the operations in Forex trading are hard to manage. This is all due to the fact that the Forex market operates 24 hours a day, while humans don’t. But thanks to the trading algorithms that we have nowadays, traders can give more protection to their investments without giving all of their time to the market.